Not only will you find very reasonable mortgage deals here, but you can also seek the advice of experts who will advise you on how to repay a mortgage at any given moment of its repayment. Regardless of whether you are planning to take out a loan, or you are just waiting to pay the last few installments - at Scotiabank they will advise you how to get through this whole process.

Scotiabank should be entrusted, because the following statistics are rather alarming.

63% of Canadians have 10 years or more to repay the mortgage, and 33% of them haven’t taken any steps to repay it more quickly. 64% of Canadians believe that being burdened with a mortgage, you can no longer invest in anything. What's more - as many as 17% believe that eventually they will be forced to sell their house to pay off the mortgage. As many as 72% of future pensioners worry about having enough money for their retirement, and 58% of them believe that they will have to continue working during their retirement. It’s time to end this thinking and do something about it, namely, seek the advice of experts and the services at Scotiabank.

If you want to pay off your mortgage faster you can use such services as: Pay Yourself First, Reality Check RRSP and RESP Reality Check.

If you are close to the end of a mortgage repayment, then you can use tools such as the Mortgage-Free Faster Calculator or the TFSA Calculator.

When you are free from the mortgage then you have several options to consider: TFSA, the Guaranteed Income Optimizer Powered GIC Equity and Income Mutual Funds.

Scotiabank is more than just an advisor - this is a bank that supports its customers and it shows that a mortgage does not have to involve long-term sacrifices. Want to know more? Watch the video!

Thursday, 15 May 2014 16:09

The best advice at Scotiabank

The future of your and your family is paramount. What do you do if you are not sure about tomorrow? You don’t know if you’ll manage to pay off the mortgage and if you'll have a decent retirement. In such a situation, consider the help of Scotiabank!

Scotiabank is the best choice.

Are you thinking about investing in real estate in Albania? Looking for a safe and profitable opportunity? Balfin Real Estate

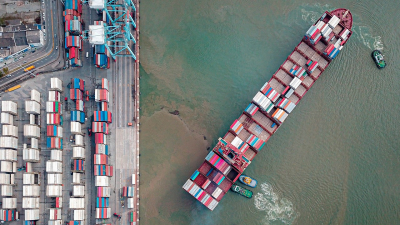

Are you thinking about investing in real estate in Albania? Looking for a safe and profitable opportunity? Balfin Real Estate The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs

The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs The Canadian government has taken decisive action following new U.S. tariffs. Prime Minister Justin Trudeau announced immediate countermeasures after President

The Canadian government has taken decisive action following new U.S. tariffs. Prime Minister Justin Trudeau announced immediate countermeasures after President