Banking basics

Opening a bank account is a crucial step for newcomers to Canada. The main Canadian banks include Royal Bank of Canada, Toronto-Dominion Bank, Bank of Montreal, Canadian Imperial Bank of Commerce, and Scotiabank. Known as the Big Five, these banks have branches and ATMs across the country, making banking accessible in most provinces and cities.

New immigrants typically open two types of accounts:

- Chequing account for daily expenses

- Savings account for setting money aside

While these banks offer accessibility, fees may be higher than at local credit unions or smaller banks.

Required documents to open a bank account

To open a Canadian bank account, immigrants must provide:

- A document with their name and current address (such as a driver’s license)

- A document with their name and birth date (such as a birth certificate)

New immigrants may also need to present a passport or visa documents. Requirements vary by bank, so it’s best to call ahead and confirm.

Understanding the Canadian tax system

Canada has a progressive tax system, which means that tax rates increase with income. According to the Canada Revenue Agency (CRA), federal tax starts at 15% for incomes below CAD 55,867 and goes up to 33% for incomes over CAD 246,752. In addition to federal taxes, provincial taxes apply. Tax returns for the previous year must be filed by April 30.

While newcomers can file taxes directly on the CRA website, professional tax preparers can be helpful, especially for the first filing. A professional can ensure accurate filing and help claim any tax credits or refunds you may be eligible for.

Retirement planning in Canada

Retirement planning is essential for long-term financial stability. The primary retirement savings options in Canada are the Registered Retirement Savings Plan (RRSP) and the Tax-Free Savings Account (TFSA). Many employers offer RRSPs with matching contributions.

Key features of these plans:

- RRSP: Pre-tax contributions reduce annual tax liability. Withdrawals are taxed at retirement.

- TFSA: Post-tax contributions allow tax-free growth of savings and investments.

Both accounts are widely available through Canada’s major banks.

Adapting to Canada’s financial system takes time. With a basic understanding of banking, taxes, and retirement planning, new immigrants can build a secure financial foundation in Canada.

source: CTV News

Are you thinking about investing in real estate in Albania? Looking for a safe and profitable opportunity? Balfin Real Estate

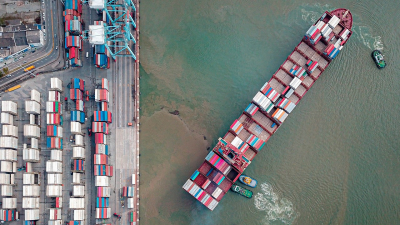

Are you thinking about investing in real estate in Albania? Looking for a safe and profitable opportunity? Balfin Real Estate The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs

The issue of tariffs has gained significant attention in Canada following months of warnings from U.S. President Donald Trump. Tariffs The Canadian government has taken decisive action following new U.S. tariffs. Prime Minister Justin Trudeau announced immediate countermeasures after President

The Canadian government has taken decisive action following new U.S. tariffs. Prime Minister Justin Trudeau announced immediate countermeasures after President